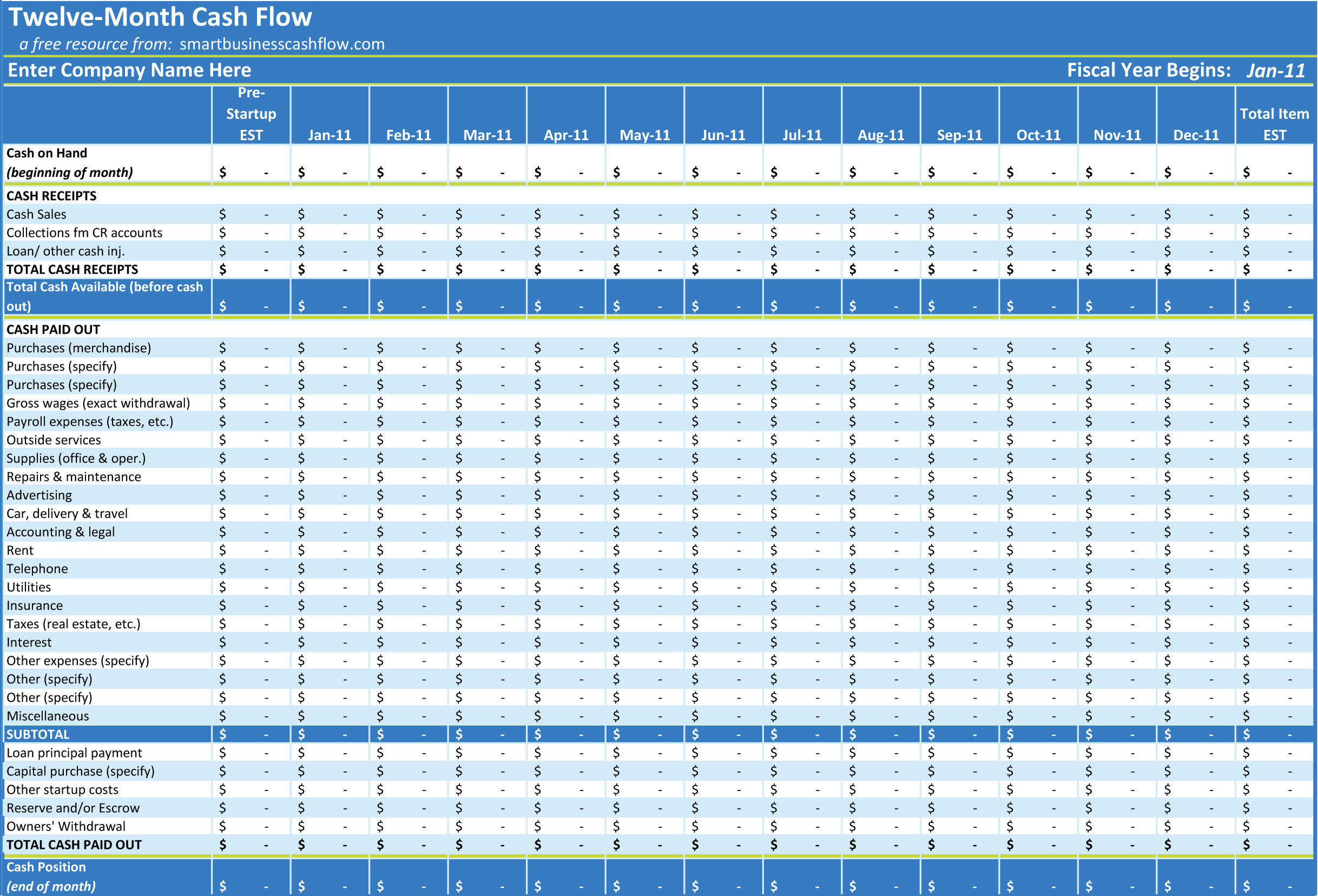

We ate some that night, and I froze the rest in large mason jars (we’re anti-plastic as much as possible). It turned into a creamy red curry coconut lentil stew with whatever veggies we had on hand. After reading it I was inspired to make some sort of lentil stew. Buying them dried is something I’ve never considered until you. I loved your article that talked about lentils and other dried beans, etc. My parents made make-ahead meals all growing up, I love them. I’ve been working out everyday, sometimes once in the morning and once in the afternoon, although it’s tough trying to drag my butt out of bed every so often. I am a pastry chef by trade, working in an underpaid job that I am thoroughly unenthusiastic about, actively trying to become fit and frugalicious. Going on 27 years old, am fair skinned and in the last couple years I have noticed the wrinkles or the “fine lines” starting to happen. (Even tho I must admit, when I was in my 20s-early 30s, I felt that way, too!) I’ve tried sharing my budget tips with younger family members, and they shake their heads at me ’cause they don’t get it (or maybe they just don’t get ME, go figure!) They think it’s just a little crazy or silly to do. If there were changes (and there usually were), I knew where the changes were coming from & where I needed to reevaluate that purchase that I considered a “little something extra” (mainly the frozen coffees I splurged on a couple days a week since the deli in my office building sold them).and then I invested in a small blender from a nearby thrift store ($3.00+change) & concocted my own recipe with the items already in my pantry! (try that for a few weeks & watch your budget have a surplus!) I kept a small memo tablet in my purse & jotted down any- and everything “extra” so I could enter it during the weekly check-up. I was diligent with using this spreadsheet & checked it on a weekly basis. When I used this spreadsheet, I’d plug in all those non-changing items for the whole year (rent, transit expenses, cable, cell phone bill), and for other utilities, I averaged six months worth & added $10 to whatever the average was – since one bill is never the same unless you’re on some type of budget plan – With this guesstimate, I found that I generally had money back in my pocket which I applied to paying off a credit card here’n’there! The other “tools” I’ve used mainly show what I’m spending & when/where I’m spending it (like, when a bill is due, I open my budget spreadsheet, enter the amounts being paid, click AutoSum, and I’m done with it.) Still, I’m finding that I don’t have quite the same “stick-with-it” attitude doing it that way as I do with this one. I personalized it more by adding in extra columns to reflect my bi-weekly pay dates. I’ve used several others since, but I think I’m going back to this one it really is the best. This spreadsheet is very similar to one I used a few years ago. Little reviews and updates can add up to big changes. Step 5: Repeat, Revisit, Review!Ĭheck in with your spending, earning, and debt reduction. By facing the hard stuff and making changes you’ll turn your money around, rather than turning your back on your money.

Step 4: Turn it around!įacing the numbers and looking for ways to cut spending, increase income, or changing spending habits can be a messy uncomfortable process. Wherever you spend, however much you owe, whatever you save - Your monthly totals are not your self worth, it’s your starting line. Family: Childcare, allowance, activities, books, toys.Routine Expenses: Groceries, clothing, personal.Enjoyment: Gifts, holiday, pets, entertainment, restaurants, hobbies.Financial: Bank fees, interest payments, debt repayment, savings accounts.Medical: Prescriptions, dental, health insurance.Utilities: Streaming, internet, phone, electricity, water.Transportation: Car, transit, fuel, maintenance, bicycle.Home Expenses: Rent, mortgage, insurance, maintenance, property taxes.Income: Salary, bonuses, investments, spousal income.Fill in the blanks and account for your cash.

Grab your receipts, sort your bills, and check your bank accounts. But getting past the feels can lead to greater money confidence and increased financial independence. Feeling overwhelmed and stressed is normal.

0 kommentar(er)

0 kommentar(er)